Imagine waking up to see your crypto portfolio quietly growing, earning you rewards while you sleep. Sounds like a dream, right? Well, it's not just a dream; it's the reality of passive income in the crypto world. But with so many platforms and strategies available, how do you choose the right one for you?

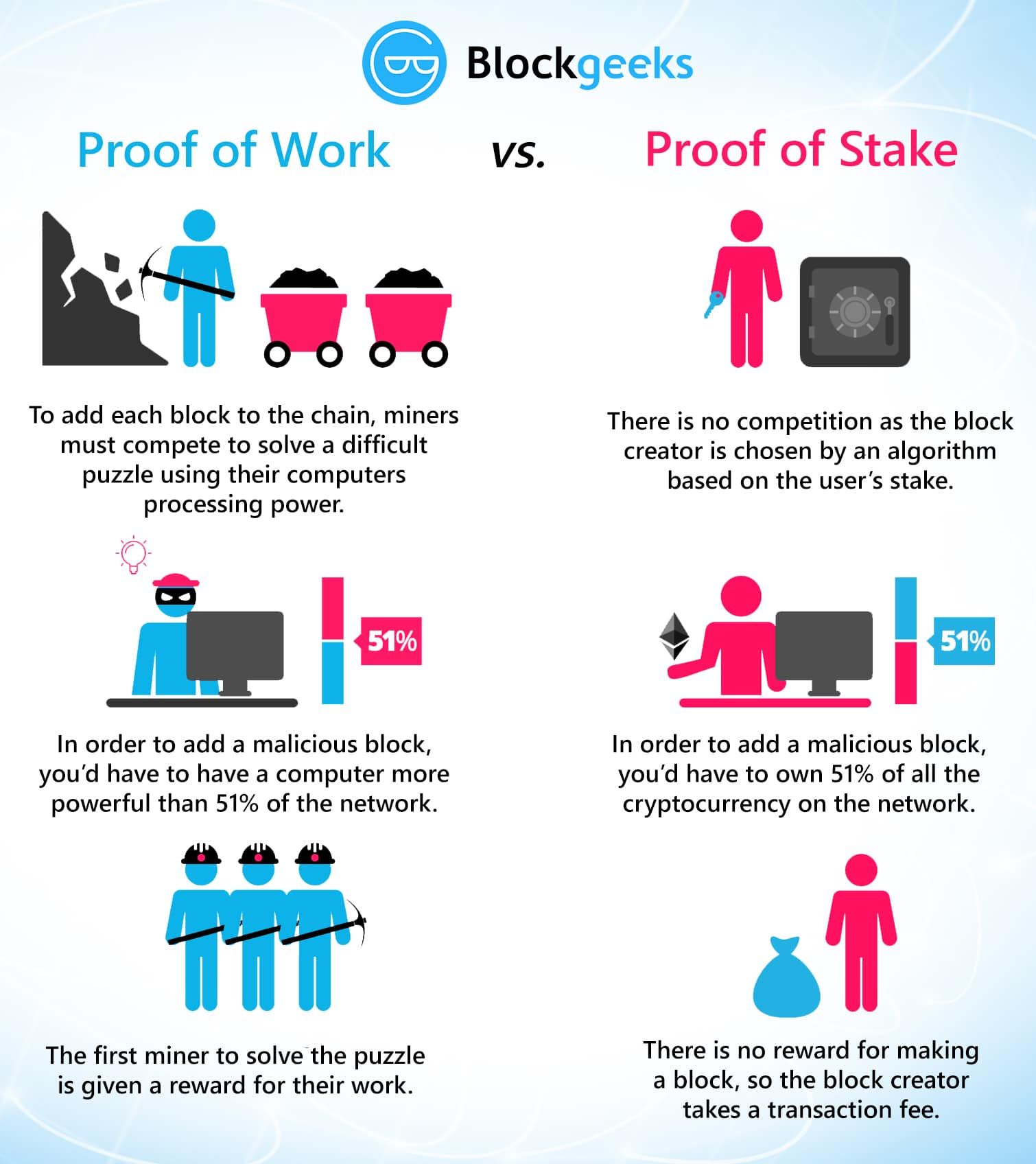

Navigating the world of crypto passive income can feel overwhelming. You're bombarded with options, from staking to lending to mining, each with its own complexities and potential risks. Figuring out which platform offers the best returns, the safest environment, and aligns with your understanding of Proof-of-Work (Po W) and Proof-of-Stake (Po S) can be a real challenge.

This guide will walk you through the best platforms for crypto passive income strategies, focusing on the key differences between Proof-of-Work and Proof-of-Stake systems. We'll explore various platforms, highlighting their strengths and weaknesses, and ultimately help you make informed decisions to maximize your earnings.

This article explores how to generate passive income through cryptocurrency platforms, focusing on strategies related to Proof-of-Work (Po W) and Proof-of-Stake (Po S) consensus mechanisms. We'll dive into platforms offering staking, lending, yield farming, and mining opportunities, examining their associated risks and rewards. By understanding the nuances of each platform and strategy, you can optimize your crypto investments for passive income generation.

Understanding Proof-of-Work (Po W) Platforms

When I first started exploring crypto, Proof-of-Work seemed incredibly intimidating. I remember reading about Bitcoin miners and their massive warehouses filled with specialized hardware. It felt so far removed from my own capabilities. I initially dismissed it as something only big players could participate in. However, as I learned more, I realized there were ways to engage with Po W-related passive income strategies, albeit indirectly. Platforms that support mining pools, for example, allow individuals to contribute their computing power and receive rewards proportionally to their contribution. While the barrier to entry is still higher than staking on a Po S platform, the potential rewards can be significant.

Proof-of-Work relies on computational power to validate transactions and secure the blockchain. In the context of passive income, Po W typically involves mining. Platforms that support Po W cryptocurrencies often offer mining pools where you can pool your resources with other miners to increase your chances of earning rewards. The rewards are distributed based on your contribution to the pool's hash rate. Popular Po W coins include Bitcoin and Litecoin, but mining these directly can be expensive due to the hardware requirements. Mining pools can mitigate this cost, but you'll still need to consider electricity consumption and the cost of specialized mining equipment (ASICs). Platforms like Slush Pool or Via BTC can provide access to mining pools, but remember that profitability depends heavily on the price of the mined cryptocurrency and your operational costs. Another way to generate passive income with Po W is through cloud mining services, where you rent hashing power from a provider. However, these services often come with higher risks and require careful due diligence to avoid scams. Ultimately, passive income generation from Po W cryptocurrencies requires significant investment and technical understanding. You need to stay updated on the latest hardware advancements, mining difficulty adjustments, and the overall market trends to maximize your profitability.

Exploring Proof-of-Stake (Po S) Platforms

Proof-of-Stake offers a different approach to validating transactions and securing the blockchain. Instead of relying on computational power, Po S uses staked cryptocurrency to select validators. In essence, you're locking up your coins to help secure the network, and in return, you receive staking rewards. The percentage of rewards varies depending on the specific cryptocurrency and the platform you're using. Platforms like Binance, Coinbase, and Kraken offer staking services for various Po S coins, making it relatively easy to participate. The barrier to entry is typically lower than with Po W, as you don't need specialized hardware. You simply need to hold the required amount of the specific cryptocurrency. Some platforms offer "liquid staking" where you can stake your coins and still use them for other purposes, like trading, through representative tokens. This enhances flexibility and allows you to potentially earn even more rewards. However, there are also risks associated with staking. "Slashing," where your staked coins are penalized for malicious behavior or network downtime, is a concern. Lock-up periods, where you can't access your staked coins for a certain period, can also be a drawback. Additionally, the staking rewards can fluctuate depending on network conditions and the number of participants. Carefully research the risks and rewards of each Po S platform before committing your funds. Consider factors like the platform's reputation, security measures, and the specific terms of the staking agreement. Diversifying your staked assets across multiple platforms can also help mitigate risk.

The History and Myth of Crypto Passive Income

The idea of passive income in the crypto world is relatively new, born from the innovation surrounding blockchain technology and decentralized finance (De Fi). The myth, however, is that it's a guaranteed path to riches with minimal effort. The reality is that while passive income opportunities exist, they come with inherent risks and require careful consideration. Early Bitcoin miners, for example, were able to generate significant profits due to the low mining difficulty and the increasing value of Bitcoin. This fueled the myth of easy money. As the crypto market evolved, Proof-of-Stake mechanisms emerged, offering an alternative to energy-intensive mining. Staking became popular, but the rewards are not always consistent and can be affected by market volatility. De Fi platforms introduced yield farming, where users could earn rewards by providing liquidity to decentralized exchanges. This offered even greater potential returns, but also came with increased complexity and the risk of impermanent loss. The history of crypto passive income is intertwined with innovation and speculation. It's important to separate the myths from the realities and to understand the underlying risks before investing your funds. Don't fall for promises of guaranteed high returns, and always do your own research. Understanding the historical context of these strategies can help you make more informed decisions and avoid potential pitfalls. Remember that the crypto market is constantly evolving, and new opportunities and risks are always emerging.

Unveiling the Hidden Secrets of Crypto Passive Income

The true "secret" to successful crypto passive income isn't about finding a magic formula or a guaranteed high-yield platform. It's about understanding the underlying technology, managing risk effectively, and staying adaptable to the ever-changing market. One key aspect often overlooked is the importance of security. Many platforms offer attractive returns, but they may also have vulnerabilities that could expose your funds to theft. Look for platforms with strong security measures, such as multi-factor authentication, cold storage of funds, and regular security audits. Another secret is to diversify your passive income streams. Don't put all your eggs in one basket. Explore different strategies, such as staking, lending, and yield farming, across multiple platforms. This reduces your overall risk and increases your chances of generating consistent returns. Finally, staying informed is crucial. The crypto market is constantly evolving, and new platforms and strategies are emerging all the time. Keep up-to-date with the latest news, research new projects thoroughly, and be prepared to adjust your strategy as needed. The "hidden secret" is simply a combination of diligence, knowledge, and risk management. It's about taking a calculated approach to generating passive income in the crypto world, rather than blindly chasing high yields. Remember that there's no such thing as a free lunch, and any investment opportunity that seems too good to be true probably is.

Recommendations for the Best Platforms

When recommending platforms for crypto passive income, it's crucial to emphasize that there's no one-size-fits-all solution. The best platform for you depends on your risk tolerance, investment goals, and technical expertise. For beginners, platforms like Binance and Coinbase offer user-friendly interfaces and a wide range of staking options for popular Po S coins. These platforms are generally considered relatively safe and reliable, but they also charge fees for their services. For more advanced users, platforms like Aave and Compound offer lending and borrowing opportunities with potentially higher returns, but also higher risks. These De Fi platforms require a deeper understanding of smart contracts and impermanent loss. When evaluating platforms, consider factors like the platform's reputation, security measures, the available cryptocurrencies, the staking or lending rates, and the associated fees. Always do your own research and don't rely solely on recommendations from others. It's also a good idea to start with small amounts and gradually increase your investment as you become more comfortable with the platform and the specific strategies. Remember that the crypto market is volatile, and even the best platforms are not immune to risks. Diversification is key to mitigating risk and maximizing your chances of generating consistent passive income. Finally, be wary of platforms promising unrealistically high returns, as these are often scams or Ponzi schemes.

Diving Deeper into Staking Rewards

Staking rewards are the incentives paid to users who participate in securing a Proof-of-Stake (Po S) blockchain by locking up their cryptocurrency holdings. These rewards are typically distributed in the form of the same cryptocurrency being staked. The amount of rewards you receive depends on several factors, including the amount of cryptocurrency you stake, the length of time you stake it for, and the overall network conditions. Some platforms offer fixed staking rates, while others offer variable rates that fluctuate based on the number of participants and the network activity. It's important to understand the difference between these types of staking arrangements before committing your funds. Another key consideration is the lock-up period. Some platforms require you to lock up your staked coins for a specific period of time, during which you cannot access or trade them. This can be a drawback if you need to access your funds quickly, but it can also incentivize you to hold your coins for the long term. When choosing a staking platform, consider the platform's reputation, security measures, and the specific terms of the staking agreement. Also, research the underlying cryptocurrency being staked. Understanding its fundamentals, market capitalization, and potential future growth is crucial for making informed investment decisions. Finally, remember that staking rewards are not guaranteed, and they can fluctuate depending on network conditions. Be prepared to adjust your strategy as needed to maximize your returns and mitigate risk.

Tips for Maximizing Crypto Passive Income

Maximizing your crypto passive income requires a strategic approach and a commitment to ongoing learning. Here are some tips to help you get the most out of your investments: Diversify your holdings: Don't put all your eggs in one basket. Spread your investments across multiple cryptocurrencies and platforms to reduce your risk. Research thoroughly: Before investing in any cryptocurrency or platform, do your due diligence. Understand the underlying technology, the team behind the project, and the potential risks and rewards. Stay informed: The crypto market is constantly evolving, so it's important to stay up-to-date on the latest news and trends. Follow industry experts, read reputable news sources, and participate in online communities. Manage your risk: Don't invest more than you can afford to lose. Cryptocurrency investments are inherently risky, so it's important to manage your risk effectively. Use stop-loss orders, diversify your holdings, and be prepared to adjust your strategy as needed. Take advantage of compounding: Reinvest your earnings to earn even more over time. Compounding can significantly boost your returns in the long run. Consider tax implications: Cryptocurrency investments are subject to taxes, so it's important to understand the tax implications of your passive income strategies. Consult with a tax professional to ensure you're complying with all applicable laws. Secure your accounts: Use strong passwords, enable two-factor authentication, and store your private keys securely to protect your accounts from hackers. By following these tips, you can significantly increase your chances of generating consistent and sustainable passive income in the crypto world.

Understanding Impermanent Loss

Impermanent loss is a key risk to be aware of when participating in decentralized finance (De Fi) activities like yield farming. It occurs when the price of the tokens you provide liquidity for in a liquidity pool diverges. The larger the divergence, the greater the impermanent loss. The term "impermanent" refers to the fact that the loss is only realized if you withdraw your liquidity from the pool. If the prices of the tokens return to their original ratios before you withdraw, the loss disappears. However, if the prices continue to diverge, the loss becomes permanent upon withdrawal. To understand why impermanent loss occurs, consider a liquidity pool containing equal amounts of two tokens, A and B. If the price of token A increases relative to token B, arbitrageurs will add token B to the pool and remove token A until the price ratio reflects the broader market. This process reduces the value of your share of the pool compared to simply holding the tokens separately. To mitigate the risk of impermanent loss, consider providing liquidity for stablecoin pairs, as their prices are less likely to diverge significantly. Also, choose pools with high trading volume and low slippage, as these are less susceptible to arbitrage. Finally, carefully monitor the prices of the tokens you provide liquidity for and be prepared to adjust your strategy as needed. Understanding impermanent loss is crucial for making informed decisions in the De Fi space and maximizing your returns.

Fun Facts About Crypto Passive Income

Did you know that the first recorded staking reward was paid out on the Peercoin blockchain in 2012? Peercoin pioneered the Proof-of-Stake consensus mechanism and paved the way for the passive income opportunities we see today. Another fun fact is that some crypto millionaires have made their fortunes solely through staking and yield farming. By strategically investing in promising Po S coins and providing liquidity to De Fi protocols, they've generated substantial returns over time. It's also interesting to note that the energy consumption of Proof-of-Stake blockchains is significantly lower than that of Proof-of-Work blockchains. This makes Po S a more environmentally friendly option for generating passive income. Furthermore, the De Fi space is constantly evolving, with new protocols and strategies emerging all the time. This means that there are always new opportunities to explore and potentially generate even higher returns. However, it also means that the risks are constantly changing, so it's important to stay informed and adapt your strategy as needed. Finally, the concept of "crypto passive income" is still relatively new, and its long-term sustainability is yet to be determined. However, it has the potential to revolutionize the way we think about investing and generating income. By understanding the underlying technology, managing risk effectively, and staying adaptable to the ever-changing market, you can position yourself to benefit from this exciting trend.

How to Get Started with Crypto Passive Income

Getting started with crypto passive income can seem daunting, but it's actually quite straightforward with the right guidance. First, you'll need to choose a cryptocurrency to invest in. Consider factors like its market capitalization, potential for growth, and the availability of staking or lending opportunities. Next, you'll need to choose a platform to use. As mentioned earlier, platforms like Binance, Coinbase, and Kraken offer user-friendly interfaces and a wide range of options. Once you've chosen a platform, you'll need to create an account and verify your identity. This typically involves providing personal information and uploading identification documents. After your account is verified, you can deposit funds using various methods, such as bank transfers or credit cards. Once you have funds in your account, you can start exploring the different passive income strategies. If you're interested in staking, simply choose a Po S coin and follow the platform's instructions to stake your coins. If you're interested in lending, you can lend your cryptocurrency to other users on the platform and earn interest. Before you start investing, it's important to understand the risks involved and to manage your risk effectively. Don't invest more than you can afford to lose, and diversify your holdings to reduce your overall risk. Finally, remember to stay informed and adapt your strategy as needed. The crypto market is constantly evolving, so it's important to stay up-to-date on the latest news and trends. With a little research and effort, you can start generating passive income with cryptocurrency and build a more secure financial future.

What If Crypto Passive Income Disappears?

The question of what happens if crypto passive income disappears is a valid one, as the crypto landscape is still relatively nascent and subject to change. Several factors could potentially lead to a decline or disappearance of these opportunities. Regulatory changes could significantly impact the availability and legality of staking, lending, and yield farming. Governments around the world are still grappling with how to regulate cryptocurrencies, and stricter regulations could make it more difficult to generate passive income. Technological advancements could also disrupt the current landscape. New consensus mechanisms or De Fi protocols could render existing strategies obsolete. Increased competition could also drive down yields. As more people participate in staking and yield farming, the rewards may decrease, making it less attractive for investors. Market crashes could also significantly impact the value of cryptocurrencies and the profitability of passive income strategies. A sharp decline in the price of a staked coin could wipe out any accumulated rewards. If crypto passive income opportunities were to disappear, it would have a significant impact on the crypto community. Many investors rely on these strategies to generate income and grow their portfolios. The disappearance of these opportunities could lead to a decline in investment and adoption of cryptocurrencies. However, it's also important to remember that the crypto market is constantly evolving and innovating. Even if current strategies become obsolete, new opportunities are likely to emerge. The key is to stay informed, adapt to change, and manage your risk effectively.

Listicle of Best Platforms for Crypto Passive Income Strategies in Proof of Work vs. Proof of Stake

Here's a quick listicle highlighting some of the best platforms for generating crypto passive income, categorized by Proof-of-Work (Po W) and Proof-of-Stake (Po S):

- Binance: Offers staking for a wide variety of Po S coins, as well as lending and yield farming opportunities. User-friendly interface and high liquidity.

- Coinbase: A popular platform for beginners, offering staking for select Po S coins with a simple and secure interface.

- Kraken: Another reputable platform offering staking services for various Po S coins, with competitive rates and a focus on security.

- Aave: A leading De Fi platform for lending and borrowing cryptocurrencies, offering potentially high returns but also higher risks.

- Compound: Similar to Aave, Compound allows users to lend and borrow cryptocurrencies, with interest rates algorithmically determined by supply and demand.

- Slush Pool: A well-established Bitcoin mining pool that allows individuals to contribute their hashing power and earn rewards.

- Via BTC: Another popular Bitcoin mining pool with a global presence and competitive fees.

- Block Fi: Offers interest-bearing accounts for various cryptocurrencies, allowing users to earn passive income without actively trading.

- Celsius Network: Similar to Block Fi, Celsius Network offers interest-bearing accounts and crypto-backed loans.

- Nexo: Provides instant crypto loans and interest-bearing accounts, with a focus on security and regulatory compliance.

Remember to do your own research before choosing a platform and to manage your risk effectively.

Question and Answer about Best Platforms for Crypto Passive Income Strategies in Proof of Work vs. Proof of Stake

Q1: What's the main difference between Po W and Po S passive income strategies?

A1: Po W involves mining, requiring significant computational power and specialized hardware, while Po S involves staking, where you lock up your existing cryptocurrency holdings to earn rewards.

Q2: Is staking risk-free?

A2: No, staking is not risk-free. Risks include "slashing" (penalties for malicious behavior), lock-up periods where you can't access your funds, and fluctuations in staking rewards.

Q3: What is impermanent loss, and how can I avoid it?

A3: Impermanent loss occurs in liquidity pools when the price of tokens diverges. You can mitigate it by providing liquidity for stablecoin pairs and choosing pools with high volume and low slippage.

Q4: Are platforms that promise high returns always legitimate?

A4: No, be wary of platforms promising unrealistically high returns, as these are often scams or Ponzi schemes. Always do your own research and prioritize security.

Conclusion of Best Platforms for Crypto Passive Income Strategies in Proof of Work vs. Proof of Stake

Exploring crypto passive income strategies in Proof-of-Work and Proof-of-Stake systems offers exciting opportunities for earning rewards. While Po W involves resource-intensive mining, Po S allows you to earn by staking your cryptocurrency holdings. Platforms like Binance, Coinbase, Kraken, Aave, and Compound offer a range of options, each with its own risks and rewards. Remember to diversify your investments, manage your risk effectively, and stay informed about the evolving crypto landscape. By understanding the nuances of each platform and strategy, you can make informed decisions to maximize your passive income potential.