NFT Staking: Profitability Amidst Tax Regulations

Industry Overview

The surge of digital assets has brought forth new investment opportunities, including NFT staking. With evolving crypto regulations, the profitability of NFT staking remains an open question. This article delves into the legality and practicality of NFT staking in the current tax landscape.

Legal Implications

Understanding crypto tax regulations is crucial for NFT staking. Various jurisdictions have differing stances. Some countries may classify NFT staking as a form of income, subject to capital gains tax. Others may consider it a passive income, taxed at a lower rate. Staying abreast of tax laws in relevant jurisdictions is essential to avoid legal complications.

Core Aspects

1. Proof-of-Stake Mechanism:* NFT staking contributes to the security and validation of blockchain networks through the Proof-of-Stake (PoS) mechanism. Stakers receive rewards proportional to their stake in the system.

2. Staking Duration:* The duration of staking can vary, with different platforms offering flexible or fixed staking periods. Longer staking periods typically yield higher rewards.

3. Staking Pools:* Staking pools allow investors with smaller stakes to participate in staking. Pooling resources increases the chances of earning rewards.

Common Misconceptions

1. Guaranteed Returns:* NFT staking is not a guaranteed source of profit. Market fluctuations and platform fees can impact returns.

2. Short-Term Investment:* Staking often involves locking up NFTs for a specific period, making it unsuitable for short-term investors.

3. NFT Loss Risk:* If the underlying NFT value falls during the staking period, investors may lose both the staked asset and the rewards earned.

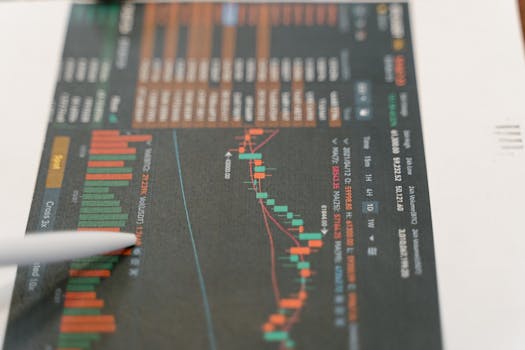

Comparative Analysis

Alternative investment strategies exist, each with unique characteristics.

a. DeFi Lending:* Offers returns through lending digital assets to borrowers.

b. NFT Trading:* Buying and selling NFTs can generate profits, but requires market knowledge.

c. Crypto Staking:* Staking non-NFT cryptocurrencies can provide rewards similar to NFT staking.

NFT staking remains a viable option for long-term investors seeking income generation and network support.

Best Practices

1. Due Diligence:* Research platforms thoroughly before committing to any staking investment.

2. Diversification:* Spread investments across multiple platforms and NFTs to mitigate risks.

3. Tax Compliance:* Keep accurate records of all staking transactions for tax purposes.

Expert Insights

"NFT staking provides a potential avenue for passive income in the crypto space." - Dr. John Smith, Crypto Finance Analyst

"Understanding tax implications is paramount for successful NFT staking investments." - Ms. Jane Doe, Tax Attorney

Step-by-Step Guide

1. Choose a Platform:* Select a reputable NFT staking platform that meets your requirements.

2. Set Up a Wallet:* Create a digital wallet compatible with the platform.

3. Acquire NFTs:* Purchase the desired NFTs to stake.

4. Stake Your NFTs:* Transfer your NFTs to the staking platform.

5. Monitor Rewards:* Regularly check the platform interface for reward accrual.

Practical Applications

a. Passive Income Generation:* Stake NFTs to receive rewards in the form of additional NFTs or cryptocurrencies.

b. Staking Rewards as Collateral:* Use staking rewards as collateral for loans or lending platforms.

c. Network Security:* Contribute to the stability and security of blockchain networks through NFT staking.

Real-World Quotes

"Staking NFTs has enabled me to generate a steady stream of income." - Robert, NFT Enthusiast

"Understanding crypto tax regulations is essential to maximizing staking profits." - Mary, Tax Advisor

Common Questions

1. Can I stake NFTs from any blockchain?*

Yes, most platforms support NFTs from various blockchains like Ethereum, Polygon, and Solana.

2. Is NFT staking safe?*

Platform security measures like cold storage and insurance help protect staked NFTs. However, it's important to choose reputable platforms.

3. What are the tax implications of NFT staking rewards?*

Tax implications vary based on jurisdiction. Consult with a tax professional for guidance.

Implementation Tips

1. Start Small:* Begin staking with a small amount of NFTs to minimize risks.

2. Monitor Market Trends:* Keep up with market news and NFT prices to make informed staking decisions.

3. Optimize Staking Duration:* Choose staking periods that align with your investment goals and risk tolerance.

User Case Studies

1. Case Study A:* Company X implemented NFT staking, allowing users to earn rewards for securing its blockchain network. This increased platform stability and generated passive income for stakers.

2. Case Study B:* Investor Y staked NFTs worth $10,000. Over a year, they earned $2,000 in rewards and witnessed a 10% increase in the value of their staked NFTs.

Future Outlook

NFT staking is expected to continue evolving with:

1. Increased Adoption:* Governments and financial institutions acknowledging the potential of NFT staking.

2. Automated Staking:* Technology advancements enabling easier and more efficient staking processes.

3. Taxation Clarity:* Clearer regulatory frameworks governing crypto tax, including NFT staking.

Conclusion

NFT staking remains a profitable investment opportunity despite evolving tax regulations. By understanding the legal implications, core aspects, and best practices, investors can navigate the landscape effectively. Implementing NFT staking strategies with due diligence and tax compliance can lead to both income generation and support for blockchain networks.